The Gift of South Dakota

Subscriptions to South Dakota Magazine make great gifts!

Subscribe today — 1 year (6 issues) is just $29!

A Taxing Time of Year

As you probably know, it's March. Which means it will soon be April — that foulest of moons when the Internal Revenue Service turns us all upside down and shakes us to see what falls out. Actually, they've been taking our money all year long. But on April 15 they ask us to cooperate in our own fleecing: Please fill out these forms so we can see if we've gotten absolutely everything we can out of you.

Oh, by the way, if you lie to us we may have to send you to jail. Sorry.

Most of us have been so terrorized by IRS horror stories we fess right up. As our pencil is poised over line 29, visions of guys in flak jackets busting down our front door flash across our mind. "You didn’t think we'd miss that $10 you won on the Super Bowl, did you?" growls Agent X, sticking his machine gun one millimeter from your nose. "Well, you were wrong! And now we're going to confiscate your house!"

I used to wonder if they could really be all that great at tracking down malingerers. What if all those horror stories are actually made up by bureaucratic toadies with job titles like Rumor Monger III?

At the risk of spreading tax collector phobia even further, let me just say that I am now a believer. All it took was one trip to our local Social Security office. In the course of filling out a history of my employment I realized that, according to my account, there must have been periods when I lived on nothing but air and sunsets. Either that or there were some gaps in my memory.

I decided the latter was more likely, for a couple reasons. One is that I've held a lot of different jobs in my life, several of which I've done my best to forget. Reason number two is that before I got married, my complete personal financial records could fit in a shoebox, with plenty of room left over for the shoes. When I saw the words COPY FOR YOUR RECORDS I took it as a personal challenge to throw it away as quickly as possible.

Then, to top it off, I lost the shoebox.

Not to worry, said my friendly Social Security representative. With nothing but my social security number and about 30 seconds of computer time, she was able to produce a printout listing every job I'd ever had.

That cliché “They knew more about me than I knew about myself” came to life before my very eyes. They knew about my truck driving job that lasted three days. They knew about one summer spent custom combining. They knew about one incredibly long month spent sanding six by eight inch pieces of wood and then attaching plaques that said "Jesus Loves You" to them.

They knew about my time on a giant construction project where I worked about an hour a day and got paid for ten. You see, I was assigned to assist a guy named Beano — who did not want or need an assistant. So I smoked a lot of cigarettes, listened to tales of Beano's often stormy home life and occasionally ran an errand for him. It was a high point in my working life.

They knew about jobs I loved, jobs I hated, and everything else. First I was amazed, then I got worried: After all, the government obviously knew everything about me, down to the number of holes in my underwear. Every questionable thing I'd ever done flashed in front of my eyes, starting with last year's tax return.

Not that I have anything to hide. When it comes to taxes, I've always pretty much laid the truth as best I could. Remember, you read it here if it should ever come up at my trial. You're my witnesses.

But like most taxpayers, there have been times when I've read the instructions — then reread them — and still don't have the faintest idea what they mean. I work at figuring out the right number for a while. Then, out of frustration. I simply plug in a reasonable sounding number and go on to the next line.

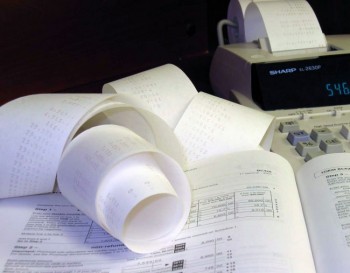

In addition to that, I still have problems with my filing system. I have good intentions, these days, as far as my records go. I've moved up from a shoebox to a peach crate filled with lots of manila folders. They sit right next to my adding machine and at least 14 sharp pencils.

But something always seems to go wrong. I'll look for a particular piece of paper, say a phone bill from March. As I locate the folder entitled PHONE BILLS, I feel good, organized and on top of things.

Let's see, here's January, February, April, May, Jun ... THERE'S NO MARCH! I frantically paw through piles of papers I don't need, ripping several, crumpling a couple, raging against that incomprehensible truth: There is no March. What goes through your mind at a time like that is similar to what occurs upon being surprised by an empty toilet paper holder.

Six months later I will find March's phone bill in a file entitled THINGS I'LL NEED TO DO TAXES. But in the meantime, what's a taxpayer to do? The IRS frowns on blank spaces — you've got to give them something. Even if you have to make it up. So it's back to the old reasonable-sounding number strategy.

As I drop my 1040 into the mail box, a fervent prayer goes along with it: Let there be a special wing in tax prison for people with pure hearts and no bookkeeping skills.

Amen.

Editor's Note: Contributing Editor Roger Holtzmann's column "Seriously, Folks" regularly appears in South Dakota Magazine. This column is revised from our March/April 1993 issue. To subscribe, call us at 800-456-5117.

Comments